Nvidia (NVDA) is a well-known name in the semiconductor industry, especially for its graphics processing units (GPUs) that power gaming, data centers, and artificial intelligence (AI) applications. The company has been enjoying a strong momentum in its stock price, which surged more than 24% in after-hours trade on Wednesday after it reported stellar earnings and revenue for the first quarter of fiscal 2024. Nvidia also gave an upbeat guidance for the second quarter, projecting sales of about $11 billion, which is more than 50% higher than Wall Street estimates.

But what is behind Nvidia’s impressive performance and outlook? And how does it relate to the broader trends and challenges in the semiconductor industry? In this article, we will explore how Nvidia’s leadership in AI drives its stock surge and why it matters for investors and consumers alike.

AI: The Key Growth Driver for Nvidia

One of the main reasons why Nvidia is outperforming its peers and the market is its strong position in the AI market, which is expected to grow at a compound annual growth rate (CAGR) of 40.2% from 2020 to 2027, reaching $997.77 billion by 2027, according to Grand View Research. AI refers to the simulation of human intelligence processes by machines, such as learning, reasoning, and decision making. AI applications span across various domains, such as healthcare, education, finance, manufacturing, and entertainment.

Nvidia’s GPUs are widely used for AI tasks that require high-performance computing (HPC), such as deep learning, natural language processing, computer vision, and speech recognition. Nvidia’s GPUs can process massive amounts of data faster and more efficiently than traditional central processing units (CPUs), making them ideal for AI workloads. Nvidia also offers software platforms and tools that enable developers and researchers to create and deploy AI applications on its GPUs, such as CUDA, TensorRT, and NVIDIA Jarvis.

Nvidia’s AI leadership is evident in its market share and revenue growth. According to Mercury Research, Nvidia had a 79% share of the discrete GPU market in the first quarter of 2023, up from 69% a year ago. Nvidia’s data center segment, which includes its AI products and services, grew 79% year-over-year to $2.05 billion in the first quarter of fiscal 2024, accounting for 30% of its total revenue. Nvidia’s data center segment also surpassed its gaming segment for the first time in the fourth quarter of fiscal 2023.

Nvidia’s AI leadership is also reflected in its innovation and partnerships. The company has been launching new products and solutions that cater to the growing demand for AI capabilities across various industries and use cases. For example, in April 2023, Nvidia unveiled Grace, its first data center CPU designed for HPC and AI applications. Grace is expected to deliver 10 times the performance of current CPUs when paired with Nvidia GPUs. Nvidia also announced a collaboration with Amazon Web Services (AWS) to offer Grace-based instances on AWS cloud by 2025.

Another example of Nvidia’s AI innovation is Omniverse, a platform that enables creators to collaborate and simulate realistic 3D worlds using Nvidia’s GPUs and software. Omniverse was launched in December 2022 and has attracted more than 400,000 users from various industries, such as architecture, engineering, construction, automotive, gaming, and entertainment. Omniverse allows users to create photorealistic scenes and animations using ray tracing and AI technologies powered by Nvidia RTX GPUs.

Nvidia’s AI partnerships span across various sectors and regions, demonstrating its wide reach and influence in the AI ecosystem. Some of its notable partners include Google (GOOGL), Microsoft (MSFT), Facebook (FB), IBM (IBM), Alibaba (BABA), Baidu (BIDU), Tencent (TCEHY), VMware (VMW), Oracle (ORCL), Dell Technologies (DELL), Hewlett Packard Enterprise (HPE), Cisco Systems (CSCO), AT&T (T), Verizon (VZ), BMW (BMWYY), Mercedes-Benz (DDAIF), Toyota (TM), Volvo (VLVLY), Audi (AUDVF), Hyundai (HYMTF), LG Electronics (LGEAF), Samsung Electronics (SSNLF), Sony (SNE), Netflix (NFLX), Disney (DIS), Electronic Arts (EA), Activision Blizzard (ATVI), Adobe (ADBE), Autodesk (ADSK), Shopify (SHOP), Spotify (SPOT), Twitter (TWTR), Zoom Video Communications (ZM), and many more.

How Semiconductors Are Related to Nvidia’s Stock Surge

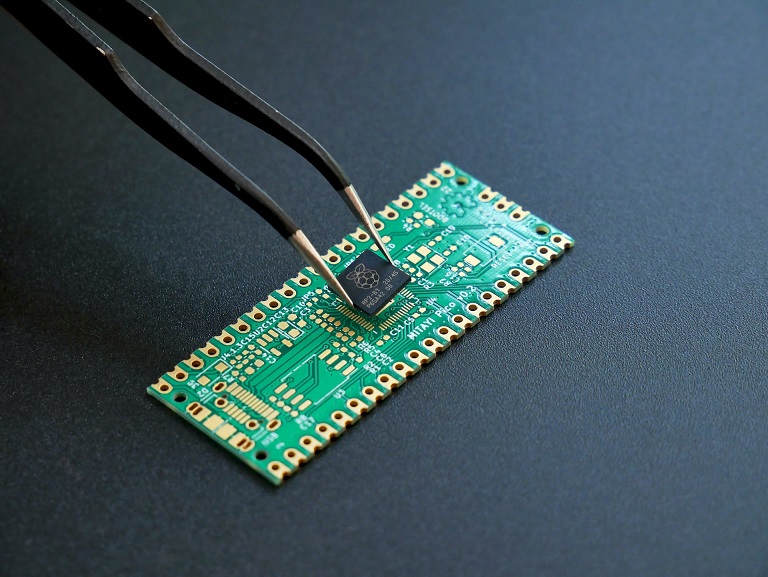

Another factor that contributes to Nvidia’s stock surge is its resilience amid the global semiconductor shortage that has been affecting various industries since late 2020. Semiconductors are essential components for electronic devices, such as smartphones, computers, cars, appliances, and medical equipment. The semiconductor shortage was caused by a combination of factors, such as surging demand for electronics during the COVID-19 pandemic lockdowns, supply chain disruptions due to natural disasters and geopolitical tensions, and limited production capacity due to underinvestment in chip manufacturing facilities.

The semiconductor shortage has impacted many companies that rely on chips for their products or services, such as Apple (AAPL), Ford (F), General Motors (GM), Honda (HMC), Nissan (NSANY), Volkswagen (VWAGY), Boeing (BA), Dell Technologies (DELL), HP Inc. (HPQ), Lenovo Group (LNVGY), Sony (SNE), Microsoft (MSFT), Nintendo (NTDOY), Qualcomm (QCOM), Broadcom (AVGO), AMD (AMD), Intel (INTC), Micron Technology (MU), and many more.

However, Nvidia has been able to mitigate the impact of the chip shortage on its business, thanks to its fabless business model, its strategic partnerships with chip manufacturers, and its diversified product portfolio. Unlike some of its competitors, such as Intel (INTC) and AMD (AMD), Nvidia does not own or operate any chip fabrication plants, also known as fabs. Instead, Nvidia designs its chips and outsources their production to third-party foundries, such as Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics (SSNLF). This allows Nvidia to focus on its core competencies of chip design and software development, while leveraging the expertise and scale of its foundry partners.

Moreover, Nvidia has established long-term relationships with its foundry partners, ensuring a stable supply of chips for its products. For example, Nvidia has been working with TSMC since 1998, and TSMC is currently producing most of Nvidia’s GPUs using its advanced 7-nanometer process technology. TSMC is also expected to produce Nvidia’s next-generation GPUs using its 5-nanometer process technology by late 2023 or early 2024. Similarly, Nvidia has been collaborating with Samsung since 2015, and Samsung is currently producing some of Nvidia’s GPUs using its 8-nanometer process technology. Samsung is also expected to produce some of Nvidia’s future GPUs using its 4-nanometer process technology by late 2023 or early 2024.

In addition, Nvidia has a diversified product portfolio that caters to different markets and segments, such as gaming, data center, professional visualization, automotive, and edge computing. This helps Nvidia reduce its dependence on any single market or segment, and allows it to capture growth opportunities across various domains. For instance, while gaming remains Nvidia’s largest segment by revenue, accounting for 49% of its total revenue in the first quarter of fiscal 2024, the company has been expanding its presence in other segments that have high demand for its GPUs and software platforms.

For example, Nvidia’s data center segment grew 79% year-over-year to $2.05 billion in the first quarter of fiscal 2024, accounting for 30% of its total revenue. Similarly, Nvidia’s professional visualization segment grew 21% year-over-year to $372 million in the first quarter of fiscal 2024, accounting for 5% of its total revenue.

Nvidia’s stock surge reflects its strong performance and outlook driven by its leadership in the AI market and its resilience amid the global semiconductor shortage. These factors not only benefit Nvidia’s shareholders but also have implications for investors, consumers, and society at large.

For investors, Nvidia’s stock surge signals that the company has a competitive edge over its peers and rivals in the semiconductor industry, and that it can capitalize on the growing demand for AI capabilities across various industries and use cases. Investors can also expect Nvidia to continue innovating and launching new products and solutions that cater to the evolving needs and preferences of its customers and partners.

For consumers, Nvidia’s stock surge means that they can enjoy better products and services powered by Nvidia’s GPUs and software platforms. Whether it is gaming, streaming, shopping, learning, working, or creating online or offline, consumers can expect faster performance, higher quality graphics, more realistic simulations, and smarter interactions from devices or applications that use Nvidia’s technologies.

For society at large, Nvidia’s stock surge indicates that the company is playing a key role in advancing AI research and development that can have positive impacts on various domains such as healthcare education.