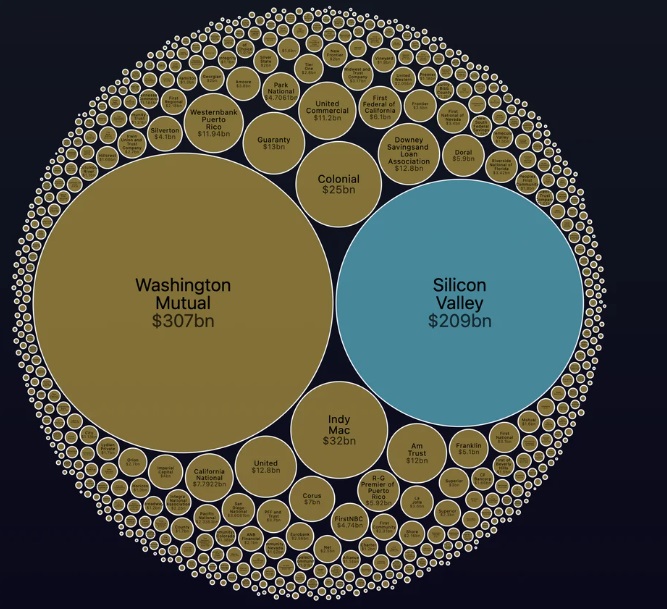

Viral Chart Showing Size of Bank Failures Since 2000 Puts in Perspective How Big the Silicon Valley Bank Crash Is

A viral chart showing the size of bank failures since 2000 puts in perspective how the recent collapse of Silicon Valley Bank (SVB) is the biggest banking disaster since Washington Mutual’s $307 billion failure in 2008. The chart, which was widely shared on social media, shows how all the other bank failures in the past two decades pale in comparison to SVB’s $209 billion crash.

The chart shows how SVB’s failure dwarfs other notable bank collapses such as IndyMac ($32 billion), Countrywide ($21 billion) and Lehman Brothers ($19 billion). The chart does not include non-bank financial institutions such as Bear Stearns or AIG, which also received government bailouts during the 2008 financial crisis.

SVB was a major lender to tech companies and startups, with clients such as Roku, Roblox, Rocket Lab and many others. The bank suffered a run on deposits after it failed to raise enough capital to meet regulatory requirements. On March 10, 2023, California regulators closed down SVB and put it under the control of the US Federal Deposit Insurance Corporation (FDIC), which is expected to sell off its assets and liabilities to other banks.

Is Roku Shutting Down Due to the Silicon Valley Bank Crash

One of the most affected companies by SVB’s collapse is Roku, a streaming device maker that had $487 million of its cash held at SVB, which represents 26% of its total cash and equivalents. Roku disclosed this information in a filing with the Securities and Exchange Commission (SEC) on March 10. Roku said it does not expect to recover any of its funds from SVB and that it may face liquidity issues as a result.

Roku also said it may be unable to pay its vendors, suppliers, employees and other obligations due to SVB’s failure. This could have a severe impact on Roku’s operations and financial performance. Some analysts have speculated that Roku may be forced to shut down or file for bankruptcy protection if it cannot find alternative sources of funding.

Other tech companies that had significant deposits at SVB include Roblox ($100 million), Rocket Lab ($70 million) and Affirm ($50 million). These companies also said they do not expect to recover their funds from SVB and that they are evaluating their options. The FDIC has said it will try to minimize disruptions for SVB’s customers and creditors, but it has not given any details on how much money they can expect to get back.

Will FDIC’s Deposit Insurance Fund Be Affected?

The FDIC has also said that SVB’s failure will not affect its deposit insurance fund, which covers up to $250,000 per depositor per insured bank. However, some experts have questioned whether the FDIC has enough resources to handle such a large bank failure amid rising interest rates and inflation pressures. The FDIC has not disclosed how much it expects to lose from SVB’s collapse.

The Silicon Valley Bank crash is a stark reminder of the risks involved in banking and lending, especially in volatile sectors such as technology. The viral chart showing the size of bank failures since 2000 illustrates how rare and devastating such events can be for both customers and shareholders.

Explore Related Articles

Kanye West Leaks Alleged Text Messages from Harley Pasternak Threatening to...

Kanye West has been torn down by the media as he continues to claim the are falsely accusing him of being anti-Semitic. However, he's not backing down for his stance, and now is leaking text messages from his personal trainer Harley Pasternak, which seems to be his version of...

‘Boycott Target’ Rap Song Allegedly Hits Number 1 on iTunes Charts...

If you have been following the music charts lately, you might have noticed a surprising entry at the top of the iTunes list. A rap song called "Boycott Target" by Forgiato Blow and Jimmy Levy has surpassed the likes of Taylor Swift and Luke Combs to become the number...

Was the UFO in Montana a Chinese Spy Balloon? Pentagon Reveals...

The U.S. National Security Agency (NSA) has been investigating reports of unidentified flying objects (UFOs) for some time now, and the Pentagon's recent decision to establish an All-Domain Anomaly Resolution Office to track reports of unidentified flying objects has recently gained traction in the news. This new office has...